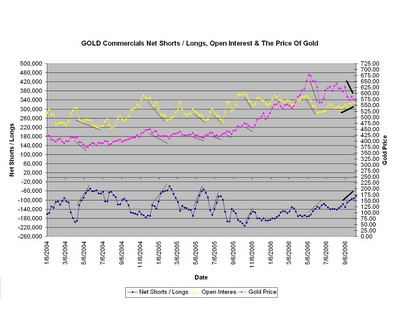

The latest Commitment of Traders (COT) report shows the lowest net short commercial positions (82.602) since June 2005 and around the low of July 2005 (82.809). Gold used to bottom when the commercial COT numbers fell in 40.000 and 60.000 until spring 2005. Afterwards when the gold rally picked up speed, the bottoming took place between 115.000 and 130.000 net short commercial positions until September 2006 when gold COT numbers fell through 100.000 down towards the June 2005 lows.

Now we can assume that given the strong gold bull market, the bottoming may take place at higher levels (let’s say around 80.000). If this is the case, the bottom may be already in place since the latest COT number is around this figure.

Nevertheless, there is a warning signal given by the open interest. We notice in the chart above that every time gold is in a correction phase and falling, both open interest and commercial net short positions in gold (the absolute number of the COT numbers, the “-“ is just indicating we have net short positions) are falling. But during the last month, gold prices are falling, COT numbers are falling and the open interest is smoothly rising (see the thick indicating lines). What should this signal? A quick resume of the uptrend or just a warning sign that correction is not over yet and on the contrary it is here to last? The answer lies in the weeks ahead and the line in the sand is 600. Until then, no trade is the best trade!

Now we can assume that given the strong gold bull market, the bottoming may take place at higher levels (let’s say around 80.000). If this is the case, the bottom may be already in place since the latest COT number is around this figure.

Nevertheless, there is a warning signal given by the open interest. We notice in the chart above that every time gold is in a correction phase and falling, both open interest and commercial net short positions in gold (the absolute number of the COT numbers, the “-“ is just indicating we have net short positions) are falling. But during the last month, gold prices are falling, COT numbers are falling and the open interest is smoothly rising (see the thick indicating lines). What should this signal? A quick resume of the uptrend or just a warning sign that correction is not over yet and on the contrary it is here to last? The answer lies in the weeks ahead and the line in the sand is 600. Until then, no trade is the best trade!

No comments:

Post a Comment