Friday, December 22, 2006

Sarbatori fericite - Happy Holidays !!!

Thursday, December 21, 2006

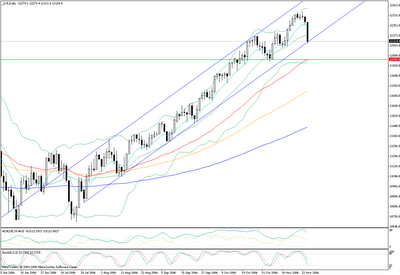

Indicii bursieri la final de an..

BET-C a testat o linie de trend venita din iulie, care a rezistat in ultima zi de tranzactionare a anului 2006. Daca va rezista si in primele sedinte de tranzactionare ale lui 2007, sunt multe sanse sa vedem noi maxime ale indicelui in perioada urmatoare.

Leul isi arata din nou coltzii..

Asa cum banuiam intr-un post trecut, caderea redutei 3.40 s-a facut nestingherita de vreo interventie din partea Bancii Centrale, insa in functie de amploarea si viteza continuarii acestui trend sub pragul de 3.40, BNR ar putea interveni in orice moment. Daca in America interventia se face cu vorbe, in Romania probabil va fi nevoie de "cash" din visterie pentru a putea preveni adancirea unui soc economic generat de aprecierea excesiva si accelerata a monedei nationale.

Wednesday, December 20, 2006

History Repeats Itself

William J. O'Neil

Source:

Trading Quotes

Tuesday, December 19, 2006

Chart of the Day - BET

Monday, December 18, 2006

Gold Correction

Sunday, December 17, 2006

SIFele dansand pe ritm de Fibonacci

Saturday, December 16, 2006

Donchian's 20 Trading Guides

1. Beware of acting immediately on a widespread public opinion. Even if correct, it will usually delay the move.

2. From a period of dullness and inactivity, watch for and prepare to follow a move in the direction in which volume increases.

3. Limit losses and ride profits, irrespective of all other rules.

4. Light commitments are advisable when market position is not certain. Clearly defined moves are signaled frequently enough to make life interesting and concentration on these moves will prevent unprofitable whip-sawing.

5. Seldom take a position in the direction of an immediately preceding three-day move. Wait for a one-day reversal.

6. Judicious use of stop orders is a valuable aid to profitable trading. Stops may be used to protect profits, to limit losses, and from certain formations such as triangular foci to take positions. Stop orders are apt to be more valuable and less treacherous if used in proper relation the the chart formation.

7. In a market in which upswings are likely to equal or exceed downswings, heavier position should be taken for the upswings for percentage reasons - a decline from 50 to 25 will net only 50% profit, whereas an advance from 25 to 50 will net 100%

8. In taking a position, price orders are allowable. In closing a position, use market orders."

9. Buy strong-acting, strong-background commodities and sell weak ones, subject to all other rules.

10. Moves in which rails lead or participate strongly are usually more worth following than moves in which rails lag.

11. A study of the capitalization of a company, the degree of activity of an issue, and whether an issue is a lethargic truck horse or a spirited race horse is fully as important as a study of statistical reports.

1. A move followed by a sideways range often precedes another move of almost equal extent in the same direction as the original move. Generally, when the second move from the sideways range has run its course, a counter move approaching the sideways range may be expected.

2. Reversal or resistance to a move is likely to be encountered:

- On reaching levels at which in the past, the commodity has fluctuated for a considerable length of time within a narrow range

- On approaching highs or lows

3. Watch for good buying or selling opportunities when trend lines are approached, especially on medium or dull volume. Be sure such a line has not been hugged or hit too frequently.

4. Watch for "crawling along" or repeated bumping of minor or major trend lines and prepare to see such trend lines broken.

5. Breaking of minor trend lines counter to the major trend gives most other important position taking signals. Positions can be taken or reversed on stop at such places.

6. Triangles of ether slope may mean either accumulation or distribution depending on other considerations although triangles are usually broken on the flat side.

7. Watch for volume climax, especially after a long move.

8. Don't count on gaps being closed unless you can distinguish between breakaway gaps, normal gaps and exhaustion gaps.

9. During a move, take or increase positions in the direction of the move at the market the morning following any one-day reversal, however slight the reversal may be, especially if volume declines on the reversal.

Source:

Richard Donchian

Friday, December 15, 2006

A trader's perspective on the world..:)

"I don't care about the numbers, the economic data, whether Iraq is in a Civil war, if the President gets impeached, who controls congress, what a company does, whether we fall into a recession or if China buys Europe and turns it into a Disney theme park. My world is defined by what I see on my four 20 inch monitors in front of me. Everything else is noise."

That's what is driving the markets."

Source:

Thursday, December 14, 2006

Charts of the Day - SIF5, DESIF5-MAR07, SIF2, DESIF2-MAR07, BET-FI, ATB, BET

O lumanare japoneza lunga ce strapunge rezistenta mediei mobile de 50 zile confirma o potentiala baza aflata deasupra maximelor din februarie, de unde cresterile se pot relua. Avem asadar un semnal de cumparare, cu stop sub suportul reprezentat de maximele aminitite din februarie.

Observam ca piata futures a SIF5 MAR07 a construit o baza similara aflata la ultima retragere Fibonacci (61.8%) de unde au reinceput cresterile, anticipandu-le pe cele de pe bursa cu 2-3 zile inainte, fiind confirmate pe ambele piete astazi.

SIF2 si-a construit o baza atat deasupra maximelor din februarie cat si deasupra mediei mobile de 50 zile, confirmand astazi pe volum reluarea cresterilor si generand un semnal de cumparare, cu stop sub maximele din februarie.

La fel ca DESIF5-MAR07, DESIF2-MAR07 si-a construit baza la ultima retragere Fibonacci (61.8%) si a reinceput cresterile, astazi fiind confirmate pe volum.

BET-FI pare ca si-a incheiat incursiunea spre sud la media mobila de 50 zile, ascensiunea de astazi ajungand la ultima retragere Fibonacci (calculata la inchideri) a cursei de corectie dintre 63.702 si 56.909. Urmeaza retragerea totala spre ultimele topuri.

Ca si o curiozitate, corectia pe ATB s-a incheiat tot la ultima retragere Fibonacci (61.8%), construind apoi o baza deasupra mediei mobile de 50 zile si reluand astazi cresterile.

BET incearca sa-si construiasca o baza deasupra suportului din jurul lui 7.850 si sa se mentina deasupra liniei de trend ascendent ce provine de la minimul de 7.735 din noiembrie, dar nu reuseste sa sparga cu hotarare rezistenta mediei mobile de 50 zile. Indicele BET nu a confirmat inca o reluare a cresterilor, insa ultimele trei zile de tranzactionare ale anului 2006 ar trebui sa ne aduca aceasta confirmare, altfel nu sunt excluse alte minime.

Wednesday, December 13, 2006

Romania si Leul

"In the spirit of my post last night about Pakistan, here is a PDF about Romania which is trying to get into the EU and then the EMU further down the road. The report notes some genuine obstacles to overcome with various imbalances and inflation but what it interesting is that the currency, the Leu (which is difficult to chart), is up 23% against the US dollar in the last two and half years. Oops."

Problema autorului legata de reprezentarea grafica a evolutiei Leului se rezolva insa..

"Yesterday I had a post about Romania and said I could not find a chart of the Romanian leu currency. Well, with a hat tip to Trader Mike, the new Google Finance has it.As I said yesterday, Romania has some clear and obvious obstacles to economic health yet YTD the dollar is down a lot against the leu.Chances are you don't care about the leu but the important thing is that it is becoming easier to access tools that used to only be available through a Bloomberg or some other expensive means. This evolution, although obvious, is very empowering for the do-it-yourselfer. And some bad video to go with this... "

Ceea ce nu stie autorul este ca acel "bad video" (de acord cu el..) de prezentare a Google Finance de mai sus este facut de un roman angajat la Google, Vivi Costache :)) Probabil acesta este motivul pentru care a gasit si graficul USDRON..:))

Sursa:

Random Roger

Tuesday, December 12, 2006

Charts of the Day - BRD, AMO, RRC

BRD isi continua scaderea dupa ce suportul mediei mobile de 50 zile a cedat. Urmatorul prag foarte important care va fi probabil bine aparat este 17.7, fosta rezistenta din timpul verii.

Grupul de speculatori anonimi:) par sa-si fi atins scopul, cel putin din punct de vedere tehnic, ducand pretul AMO la maximele din februarie (chiar depasindu-le scurt si marginal) si probabil incepand sa verse din actiuni. Inceputul declinului? Numai ei stiu..:)

Dupa momentul spargerii canalului descendent, RRC a urcat agresiv pana astazi cand isi mai trage sufletul pe fondul marcarii de profit. Pragul de 0.0870 (veche rezistenta si medie mobila) ar trebui sa reprezinte un suport puternic.

Monday, December 11, 2006

Chart of the Day - AMO

Dupa un prim test respins violent al retragerii Fibonacci de 61.8% , AMO si-a strans puterile (a se citi speculatorii) si vineri a trecut in forta, pe volume record, de ultima reduta a matematicianului italian, inchizand deasupra acesteia. Urmarea de astazi a fost..o deschidere (si inchidere) in limita superioara de variatie zilnica (+15%), ramanand acolo aproape intreaga zi de tranzactionare in conditiile in care vanzatorii disparusera din ASK. Nu e rau pentru o companie in prag de faliment..:)

Sunday, December 10, 2006

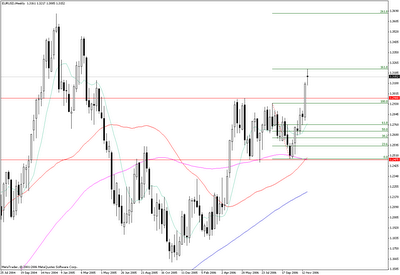

Chart of the Week - EURUSD

The hourly chart above shows us the triple top of last week and the break of a support around 1.3260, which should become the next resistance on the way back.

Thursday, December 07, 2006

The Right Side

Source:

Wednesday, December 06, 2006

Charts of the Day - SIF5, SIF2, BET-FI, RRC, BET

Dupa un mic recul de la primul test al rezistentei canalului descendent, astazi RRC a trecut din nou peste media mobila de 50 zile si a strapuns linia de trend descendent, astfel dand un semnal de cumparare care trebuie confirmat maine.

Canalul ascendent observat intr-un post recent n-a rezistat dar suportul de 7.850 a tinut iar indicele s-a intors astazi, testand canalul ascendent spart. O revenire a trendului ascendent insa nu se poate concretiza decat dupa ce va inchide hotarat peste media mobila de 50 zile, testata fara succes de patru ori in ultimele saptamani.

Tuesday, December 05, 2006

On financial speculations..

George Soros

Monday, December 04, 2006

Leul se zburleste la valute..

In graficul saptamanal al EURRON se observa ca ne apropiem de suportul aparat agresiv de BNR in vara anului trecut (3.40). O cadere sub acest prag ar putea determina BNR sa intervina din nou, desi exista destul de multe sanse sa nu o faca si de data aceasta.

Astazi BNR a folosit pentru prima data dupa mult timp o parghie mai voalata de control a cursului de schimb, determinand reducerea dobanzilor prin atragerea a mai putin de 100% din oferta de lei a bancilor din sistem astfel ducand la micsorarea diferentialului de dobanda fata de alte piete, in incercarea de-a reduce apetitul speculatorilor transfrontalieri. (Sursa: ZF)

Daca insa cursul va cadea nestingherit sub 3.40, BNR ar putea interveni la trecerea prin anumite suporturi tehnice cum ar fi 3.35, 3.20, 3.00 sau prin orice alt suport ales de guvernatorul Isarescu:))

USDRON este in cadere libera intocmai cum se afla si dollarul pe pietele internationale (vs. alte monede, in special EUR si GBP). O interventie in forta a BNR pe piata EURRON (in principal) se va face insa simtita si pe USDRON.

Friday, December 01, 2006

Warren Buffett Quotes..

"Associate with people who are better than you. Marry up, employ up, work for your heroes. Associations rub off. Tell me your heroes, I’ll tell you how you’ll turn out. "

"Ben Graham’s success exercise.

Take one hour. Think of the one classmate who you’d like to own 10% of for the rest of their life. 10% of all of their future income. What do you think about? The person who others admire and want to work with. Person who works hard and gives others credit. It’s simple. Select those qualities for yourself.

Now the fun part: who would you want to short? The guy who turns other people off.

Qualities are chosen.

Ben Graham did that. Wrote everything on a piece of paper and developed habits. You will find that you can attain or get rid of qualities accordingly. "

Source:

Warren Buffett and the Chicago Graduate School of Business

by Aquamarine Fund Diary

Thursday, November 30, 2006

Folly Of Emotions

Bernard Baruch

Source:

Trading Quotes

Wednesday, November 29, 2006

Chart of the Day - BET

Eurodollar may take a breather..

Tuesday, November 28, 2006

Warren Buffett..

Enjoy the guru..it's a pretty long recording but it's worth watching it!

Source:

Warren Buffett at The University of Florida

by Daily Dose of Optimism

The Bullish GOLDen Route

Gold has eventually managed to decisively break and close above the last Fibonacci retracement (61.8%) of the 676 - 559 trip and started the full retracement back towards 675, as noted in a previous post. The upper bull trend channel from October and the previous highs at around 655 might pose some resistance while 630 should become support.

The bullish route is backed by higher commercials net shorts and finally by increasing open interest (as seen in the chart above) which strengthens the trend.

Monday, November 27, 2006

DJIA is finally plunging..

It will be interesting to watch how much this deep US stock market correction will influence other stock markets, including the Romanian one which closed positive today though the stock futures market closed pretty much in red (a rather unusual event).

A possible explanation of the plunge..

Source:

A Story About Trading..:))

Source:

Quote of the Week

by TaylorTree

Chart of the Day - RRC: Revenirea..

BET on BET

Sunday, November 26, 2006

The eurodollar has escaped the leash

Saturday, November 25, 2006

DENNIS GARTMAN'S NOT-SO-SIMPLE RULES OF TRADING

2. Trade Like a Wizened Mercenary Soldier: We must fight on the winning side, not on the side we may believe to be correct economically.

3. Mental Capital Trumps Real Capital: Capital comes in two types, mental and real, and the former is far more valuable than the latter. Holding losing positions costs measurable real capital, but it costs immeasurable mental capital.

4. This Is Not a Business of Buying Low and Selling High; it is, however, a business of buying high and selling higher. Strength tends to beget strength, and weakness, weakness.

5. In Bull Markets One Can Only Be Long or Neutral, and in bear markets, one can only be short or neutral. This may seem self-evident; few understand it however, and fewer still embrace it.

6. "Markets Can Remain Illogical Far Longer Than You or I Can Remain Solvent." These are Keynes' words, and illogic does often reign, despite what the academics would have us believe.

7. Buy Markets That Show the Greatest Strength; Sell Markets That Show the Greatest Weakness: Metaphorically, when bearish we need to throw rocks into the wettest paper sacks, for they break most easily. When bullish we need to sail the strongest winds, for they carry the farthest.

8. Think Like a Fundamentalist; Trade Like a Simple Technician: The fundamentals may drive a market and we need to understand them, but if the chart is not bullish, why be bullish? Be bullish when the technicals and fundamentals, as you understand them, run in tandem.

9. Trading Runs in Cycles, Some Good, Most Bad: Trade large and aggressively when trading well; trade small and ever smaller when trading poorly. In "good times," even errors turn to profits; in "bad times," the most well-researched trade will go awry. This is the nature of trading; accept it and move on.

10. Keep Your Technical Systems Simple: Complicated systems breed confusion; simplicity breeds elegance. The great traders we've known have the simplest methods of trading. There is a correlation here!

11. In Trading/Investing, An Understanding of Mass Psychology Is Often More Important Than an Understanding of Economics: Simply put, "When they are cryin', you should be buyin'! And when they are yellin', you should be sellin'!"

12. Bear Market Corrections Are More Violent and Far Swifter Than Bull Market Corrections: Why they are is still a mystery to us, but they are; we accept it as fact and we move on.

13. There Is Never Just One Cockroach: The lesson of bad news on most stocks is that more shall follow... usually hard upon and always with detrimental effect upon price, until such time as panic prevails and the weakest hands finally exit their positions.

14. Be Patient with Winning Trades; Be Enormously Impatient with Losing Trades: The older we get, the more small losses we take each year... and our profits grow accordingly.

15. Do More of That Which Is Working and Less of That Which Is Not: This works in life as well as trading. Do the things that have been proven of merit. Add to winning trades; cut back or eliminate losing ones. If there is a "secret" to trading (and of life), this is it.

16. All Rules Are Meant To Be Broken.... but only very, very infrequently. Genius comes in knowing how truly infrequently one can do so and still prosper.

Source:

It's All About Your Time Frame

by John Mauldin

Sunday, November 19, 2006

Predictie BET Reloaded

Indicele BET atinge maximele din august care s-au transformat din rezistenta in suport si se intoarce nervos, putand astfel semnala o intoarcere pentru saptamanile urmatoare.

BRD inteapa media mobila suport de 50 zile si se intoarce apoi peste maximele ultimelor doua saptamani.

SNP inteapa suportul aflat la 0.57 si o linie de trend ascendent venita din iulie apoi se intoarce peste inchiderea din ziua precedenta si peste media mobila de 50 zile.

TLV inteapa adanc suportul si posibila baza de range de la 1.0 si inchide tot acolo, dar inca nu sunt destule semnale pentru o intoarcere desi pot aparea curand.

RRC incheie ultima zi a saptamanii intr-un "Doji", adica indecis, dar care se poate constitui in semnal de intoarcere venind dupa cateva zile de scaderi, insa trebuie confirmat.

SIF2 se apropie foarte mult de maximele din februarie transformate in suport cat si de media mobila de 50 zile dar este intors violent si inchide ziua de vineri pe plus intr-o lumanare care poate semnifica intoarcere.

SIF5 inchide ziua de vineri la acelasi pret la care a deschis-o, dar dupa o incursiune adanca spre suportul reprezentat de maximele din octombrie si media mobila de 50 zile. Iarasi semnal de intoarcere, daca va fi confirmat maine.